Europe Is In (Big) Trouble

By Shlomo Maital

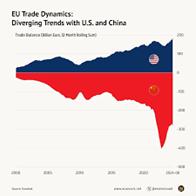

US trade deficit (top) EU trade deficit (bottom)

In her NYT Op-Ed today, March 10, Karen Karniol-Tambour clarifies President Trump’s murky tariff quirks.# I find the above diagrams helpful, along with her analysis and my own. The top diagram shows the US trade deficit (exports minus imports) since 1990, and the bottom one, the EU’s trade deficit, split between a large and growing surplus in its US trade, and a growing and very large deficit in its China trade. (Bottom diagram: Black is export surplus with the US; Red is import surplus with China). Source: Visual Capitalist.

Since 1990, and actually since 1970, the United States has consumed more than it produced. It does this by buying stuff abroad. To pay for it, it borrows and goes into debt. It can do this, because US money, the dollar, is the world currency and those who earn the dollars are willing to hold them or turn them into US bonds. (If you or tried this, it would not take long to go broke. When the US does it, it can print the money to enable it.) The infusion of US demand in the world economy has made Asia, specifically China, wealthy. There are 400 Chinese billionaires! In a Communist nation! But it also helped Europe. The EU sells more to the US than it buys.

Most of what the US consumes, above what it makes, is manufactured goods, mostly from China, but also, from Mexico, Vietnam, Japan and Germany.

The US gave away its manufacturing to China and the rest of the world, under Clinton, Bush, Obama…and Trump (2016-2020). Trump thinks it can return, by imposing high tariffs on imports. It will make us a fortune, he says. If it does, it means that imports remain very high. So – forget US manufacturing. If it doesn’t make a fortune, it means that imports become very expensive and import inflation, not just Chinese EV’s.

China has had 25 years to build its manufacturing supremacy. In a country that controls the economy directly. To get its manufacturing back, the US will need at least 25 years, probably more, in a free market economy, if, IF, all the right policies are put in place. But …of course, they are not. Tariffs are not the answer.

The EU is in huge trouble. For two reasons. Defense. And Economy.

Defense: The US is throwing Europe and Ukraine under the Russian bus. After years of sponging off the US $850 billion defense budget, Europe now has to defend itself. That will take large resources and a lot of time. And Russia is knocking on the door right now. The next few years will be very dangerous for Europe.

Economy: The US wants to shut down its big trade deficit with the EU. IF it does, through tariffs, it will hurt the EU economy, with Germany already in recession or nearly so. Meanwhile, the EU has a large and growing trade deficit in manufactures with China. Europe’s car industry is in desperate trouble. With technology shifting to electric vehicles, China is swamping the world with its EV’s, and Europe is way way behind. So Europe faces big challenges from BOTH the US and from China.

The economies of the US, EU, and China are roughly equal in size, and comprise 75% of world GDP. All three have big problems. China has a bloated construction, real estate and finance sector, deep in debt. US has an unpredictable president with wrong-headed ‘quick fixes’ that really are quick disasters. EU needs a rapid, smart, strategic U-turn, very unlikely in a group of 27 countries where you need unanimity to do anything – and outliers like Hungary are happy to put up roadblocks.

The US gave away its manufacturing to China, under four presidents, Democrats and Republicans. You cannot have a strong healthy growing economy without making stuff. The US stock markets are reflecting this.

Because the US consumed much more than it made, it has a heavy burden of debt, 110% of its GDP, and a trillion dollars in interest alone. And as Trump slashes taxes, the budget deficit grows and with it, US debt.

EU enjoyed trade surpluses with the US, offsetting in part its trade deficit with China. The US under Trump wants to end that.

In a EU economy already slowing, and with a Russian army on its flank, and with EU technology trailing that of the US and China, the EU is in deep hot water.

And, when 75% of the world economy is in some degree of trouble – we are all of us in hot water.

Friends: Set aside a bit more in saving. You may need it.

# “This Is Who Loses in a Trade War. Karen Karniol-Tambour, New York Times, March 10, 2025. The author is co-chief investment officer at Bridgewater, an investment management company.

Leave a comment

Comments feed for this article