You are currently browsing the tag archive for the ‘finance’ tag.

Why Economists are Baffled by the Data

By Shlomo Maital

What in the world is going on with the US economy? Economists are …well, out to lunch.

Why? Labor data is down. GDP growth is way up in the last quarter. Hmmm…

This is what Jason Furman, former head of the White House Council of Economic Advisors, writes in his New York Times Op-Ed piece?

“Economic data never tells a perfectly clear story, but lately the contradictions have been especially jarring. Just a week apart, the government delivered two sharply conflicting messages. One report showed job growth stalling and unemployment rising. Another showed the economy expanding at a blistering 4.3 percent annual rate — more than double the pace of the first half of the year.”

Unemployment is significantly higher than in previous periods. Job growth is small or maybe even negative. But GDP is growing at 4.3 per cent, double the rate earlier. Furman asks: Are we sliding toward recession or entering a new boom?

GDP growth without labor growth?

Could this be the result of AI replacing human labor? Probably not – Not enough companies are dumping people because their work is redundant and done by AI.

Wrong data? Job data is often wrong and updated – that brought a Trump tantrum the last time it was revised down. GDP data too is often updated.

It reminds me of the lovely sad Beatles song, with the repeated line “nothing’s going to change my world.” We economists analyze data with the insights and models and tools of the past. But…our world has changed. And so has the economy. And how people behave, spend, invest, save….

Disclosure: I have unofficially resigned from the army of professional economists. A profession that pitched unbridled capitalism, yet failed to anticipate why, say, a Board of Directors giving Elon Musk a trillion dollars in compensation might be obscene and needed fixing or forestalling – there is no hope.

I wonder what will be said to Economists when they reach the Gates of Heaven – and admit they are economists. I have a hunch.

Is Nvidia a Bubble?

By Shlomo Maital

2024: $1 tr. Nvidia market cap. 2025 $5 tr.

Nvidia has become the first company whose market value of its shares reached $5 trillion. $5 trillion! That is larger than the national GDP’s of every country except the US, UK and Germany (close tie with Germany!).

Is this a bubble?

Nvidia’s shares have risen by five times, from $1 trillion just over a year ago. The reason is clear. Nvidia’s Jensen Huang made a huge bet on AI chips…and thanks to his acquisition of Israeli startup Mellanox, founded by Eyal Waldman, his bet paid off. Nvidia has the chips that AI desperately needs… right at the moment when they were most needed. Mellanox supplied software that speeds up calculations (originally, used to speed up uploads and downloads on the Internet), which Huang cleverly realized could speed up calculations on microprocessors.

So is it a bubble? Probably. Any share that rises by five times is a bubble. Can Nvidia sustain its growth? Especially when the US is trying to shut off the Chinese market for Nvidia, a market of the world’s second largest economy.

Every sharp rise in shares is driven by future expectations and dreams. Nvidia’s 2025 profits rose to about $80 b., from around $28 billion in 2024. That’s a big rise. But a stock valuation of some 60 times net income is very high. It is a PE price-earnings ratio of 60, astronomically high.

US stock markets are now at all time highs. It is not just Nvidia. It is time to think carefully if you are in the market. There are enormous storm clouds gathering.

OpenAI: Who Am I?

By Shlomo Maital

Who am I? Can we find out about ourselves with AI?

Posting on the Medium website, Mohammed Bakry proposes the following prompt, to ask AI about someone and dig through the Internet for information:

“Do intensive research on XXXXXX and give me a massive report on everything you find. Find the needle in the haystack — something unexpected — so I can reach out with a surprising personal connection.”

So I tried it on myself. Here is the result (with my annotation):

Shlomo Maital is a renowned figure, [false; beware of AI obsequious flattery] primarily recognized for his contributions in the field of economics and innovation management. As a professor and senior researcher at the Technion – Israel Institute of Technology, he has influenced both academic circles and industry practices significantly. Maital’s work often emphasizes the practical application of economic theory in fostering innovation and entrepreneurship.

One of his noteworthy roles has been as the Academic Director of the TIM-Technion Institute of Management, which focuses on executive training and development. His research and teachings often explore the intersection of economic theory and real-world applications, striving to make complex concepts accessible to practitioners and policymakers.

Maital is also an accomplished author, having published several books and numerous articles on innovation management, creativity, and entrepreneurship. His writings frequently address the challenges organizations face in cultivating innovation and the strategies they can employ to overcome them.

An unexpected angle to explore when connecting with him could be his interest in the psychological and social aspects of economics. Maital has often focused on how behavioral insights can enhance economic policies, a topic that diverges from the traditional economic narratives and showcases his interdisciplinary approach. [Failed to mention my wife Dr. Sharone Maital, psychologist, who is and was an essential collaborator]. Engaging with him on how behavioral economics can drive sustainable innovation might serve as an unexpected yet impactful point of connection.

To reach out with a surprising personal connection, you might consider referencing his involvement with societal and educational initiatives, reflecting shared interests in how education can drive economic development and societal well-being. His emphasis on the human aspects in economic systems could provide a unique personal touch to your outreach.

[Missing: Our grandchildren and great-grandchildren, light of our lives; our synagogue Ve’ahavta, and Rabbi Elisha Wolfin, with whom I do a weekly podcast on the Bible – a deep and meaningful activity; my column in Jerusalem Report, also a huge focus for me; the think tank where I now work, S. Neaman Institute, my second family].

OK — bottom line. Who am I? AI will not help much. Who is XX? AI won’t help much.

That’s a big relief.

Trumponomics

By Shlomo Maital

(from The Economist)

“Trumponomics” is the economic theory that drives President Donald Trump’s planned economic policies. It includes low interest rates; tariffs on China, Mexico and Canada, and anyone else that sells more to the US than it buys; expelling immigrant workers; slashing taxes; removing renewable energy subsidies.

What can we expect? Here is Olivier Blanchard’s ‘take’. He is an MIT economics professor, former chief economist of the IMF.

“….perhaps the most crucial issue is what the Fed will do. If it sticks to its mandate, it will stand in the way of some of Trump’s hopes from the use of tariffs, deportation, and tax cuts. It will have to limit economic overheating, increase rates, and cause the dollar to appreciate. The big question is thus whether Trump can force the Fed to abandon its mandate and maintain low rates in the face of higher inflation.”

To explain: The US already has a huge federal budget deficit, some 7% of GDP. US public debt exceeds its annual GDP. Trumponomics tax cuts and gifts to the wealthy will further hamper revenues and increase the deficit. Tariffs will make goods and services more expensive for consumers (no, people, it is not the Chinese or Canadians who will pay the tariffs, it is us). The result will be more inflation, rather than, as promised, less.

Enter the Fed: Higher inflation brings tighter interest rates. Trumponomics is in love with low interest rates. Result: A cataclysmic conflict with Fed Chair Jerome Powell, who remains in his post until 2026. At that time, Trump may try to appoint a non-mainstream new Fed Chair, who will maintain low rates in the face of inflation – leading to more inflation.

The US has been successful since 1776, mostly, because its Judiciary (Supreme Court) and its money people (Federal Reserve) have been constitutionally isolated from political influence, in general. The judiciary now has a Trump majority. When the Fed too falls into Trumponomics – yikes. Risk premiums on US bonds rise, as capital markets start to wonder whether the US may, like Nicaragua or South Africa, fall into fiscal decay.

Here is Blanchard’s conclusion: “Fed Chair Jay Powell has made clear he remains committed to the mandate and to staying at the Fed as chair until his term as chair expires in May 2026 (his term as board member ends in 2028). Current Fed board members are unlikely to follow a different line. But one board position opens in January 2026, and Trump could seek to name a more docile board member to the seat. If this is the case, and the board goes along (which is unlikely), the result will be low rates, overheating, and higher inflation. Given the unpopularity of high inflation, not to mention the reaction of financial markets to the loss of Fed independence, this prospect may be enough to make Trump hesitate to pursue this option.”

Stay tuned! We are headed for interesting times.

G7 vs BRICS: Lose Lose.

By Shlomo Maital

As Donald Trump prepares to be inaugurated as US President on January 20, a rather bleak picture emerges of a wrestling contest between two teams: BRICS and G7. And it will not end well, at least not initially.

BRICS is the group of anti-US anti-West countries: Brazil, Russia, India, China, South Africa. According to recent figures, their total Gross Domestic Product, measured by the true dollar value of their currency rather than the distorted market value, is $62 trillion.

Facing off against them is the G7: the group of pro-West economies led by the US. Their GDP comes in total to $53 trillion. (Note: China’s GDP, in $, is $33 trillion, more than $4 trillion above that of the US, at $29 trillion).

Together, these two groups command $120 trillion of the world’s $138 trillion GDP.

Trump plans to impose tariffs, including on key trading partners such as Canada and Mexico. They and others will doubtless retaliate. This will reduce the volume of world trade, which since the 1944 Bretton Woods agreement has made many poor countries much wealthier.

We have seen this movie before. In the 1930’s Depression, the US imposed a heavy tariff on imports, the Smoot-Hawley tariff, and its trading partners retaliated. In just a few years, world trade all but disappeared, making the Depression worse for all.

Somehow, humanity seems to have to relive its mistakes again and again, and relearn their consequences. “I can make you poorer, at my expense,” says country A, and country B says, “so can I”.

And they’re both right.

If the US Economy is So Good – Why Is It Perceived as Bad?

By Shlomo Maital

Many experts – and Democrat strategists – fretted, worried, puzzled, pontificated and blustered over why the US economy did so well, by the numbers, and was perceived as so bad by working people.

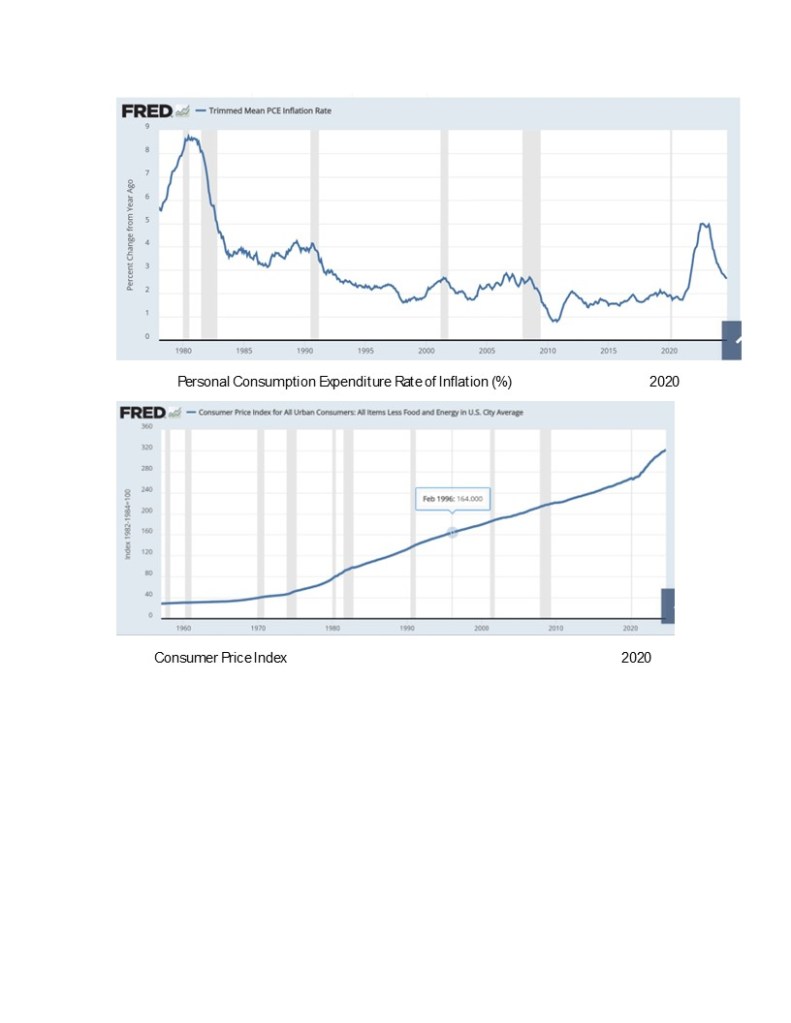

The above two graphs, thanks to the St. Louis Fed’s superb software “FRED”, provides an explanation.

In 2020 inflation (measured by the year to year percentage change in the personal consumption expenditure price index, which measures the price of what people buy) peaked at over 4% — and then fell sharply to around 2 per cent, leading the Fed to slash interest rates. See the top graph.

Good news, right?

In October 2024, just before the US Presidential election, the consumer price index was 321.7, up from April 2020’s level of 265.7. That is an increase of 21.7%. That means – what people bought just before the election was 21.7% more expensive than in April 2020, just before Biden won the election. During that time, the wages of low-income working people did not come close to rising by 21.7%. That means, a lot of people were struggling in 2024 to buy what they bought relatively easily in 2020. See the bottom graph.

The difference is simply this: Some measure inflation by the rate of change But ordinary people measure it by what they can buy at the supermarket. Good work for bringing down the rate of inflation! But – did you fix the damage the inflation did before you got it under control? Raised the national minimum wage to $15? No? Then – you will lose the election.