You are currently browsing the tag archive for the ‘trade’ tag.

Europe Is In (Big) Trouble

By Shlomo Maital

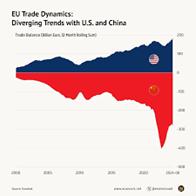

US trade deficit (top) EU trade deficit (bottom)

In her NYT Op-Ed today, March 10, Karen Karniol-Tambour clarifies President Trump’s murky tariff quirks.# I find the above diagrams helpful, along with her analysis and my own. The top diagram shows the US trade deficit (exports minus imports) since 1990, and the bottom one, the EU’s trade deficit, split between a large and growing surplus in its US trade, and a growing and very large deficit in its China trade. (Bottom diagram: Black is export surplus with the US; Red is import surplus with China). Source: Visual Capitalist.

Since 1990, and actually since 1970, the United States has consumed more than it produced. It does this by buying stuff abroad. To pay for it, it borrows and goes into debt. It can do this, because US money, the dollar, is the world currency and those who earn the dollars are willing to hold them or turn them into US bonds. (If you or tried this, it would not take long to go broke. When the US does it, it can print the money to enable it.) The infusion of US demand in the world economy has made Asia, specifically China, wealthy. There are 400 Chinese billionaires! In a Communist nation! But it also helped Europe. The EU sells more to the US than it buys.

Most of what the US consumes, above what it makes, is manufactured goods, mostly from China, but also, from Mexico, Vietnam, Japan and Germany.

The US gave away its manufacturing to China and the rest of the world, under Clinton, Bush, Obama…and Trump (2016-2020). Trump thinks it can return, by imposing high tariffs on imports. It will make us a fortune, he says. If it does, it means that imports remain very high. So – forget US manufacturing. If it doesn’t make a fortune, it means that imports become very expensive and import inflation, not just Chinese EV’s.

China has had 25 years to build its manufacturing supremacy. In a country that controls the economy directly. To get its manufacturing back, the US will need at least 25 years, probably more, in a free market economy, if, IF, all the right policies are put in place. But …of course, they are not. Tariffs are not the answer.

The EU is in huge trouble. For two reasons. Defense. And Economy.

Defense: The US is throwing Europe and Ukraine under the Russian bus. After years of sponging off the US $850 billion defense budget, Europe now has to defend itself. That will take large resources and a lot of time. And Russia is knocking on the door right now. The next few years will be very dangerous for Europe.

Economy: The US wants to shut down its big trade deficit with the EU. IF it does, through tariffs, it will hurt the EU economy, with Germany already in recession or nearly so. Meanwhile, the EU has a large and growing trade deficit in manufactures with China. Europe’s car industry is in desperate trouble. With technology shifting to electric vehicles, China is swamping the world with its EV’s, and Europe is way way behind. So Europe faces big challenges from BOTH the US and from China.

The economies of the US, EU, and China are roughly equal in size, and comprise 75% of world GDP. All three have big problems. China has a bloated construction, real estate and finance sector, deep in debt. US has an unpredictable president with wrong-headed ‘quick fixes’ that really are quick disasters. EU needs a rapid, smart, strategic U-turn, very unlikely in a group of 27 countries where you need unanimity to do anything – and outliers like Hungary are happy to put up roadblocks.

The US gave away its manufacturing to China, under four presidents, Democrats and Republicans. You cannot have a strong healthy growing economy without making stuff. The US stock markets are reflecting this.

Because the US consumed much more than it made, it has a heavy burden of debt, 110% of its GDP, and a trillion dollars in interest alone. And as Trump slashes taxes, the budget deficit grows and with it, US debt.

EU enjoyed trade surpluses with the US, offsetting in part its trade deficit with China. The US under Trump wants to end that.

In a EU economy already slowing, and with a Russian army on its flank, and with EU technology trailing that of the US and China, the EU is in deep hot water.

And, when 75% of the world economy is in some degree of trouble – we are all of us in hot water.

Friends: Set aside a bit more in saving. You may need it.

# “This Is Who Loses in a Trade War. Karen Karniol-Tambour, New York Times, March 10, 2025. The author is co-chief investment officer at Bridgewater, an investment management company.

Blue Collars Lose Ground – Don’t Blame Trade

By Shlomo Maital

Led by the Trump Administration in the US, worldwide there is a counter-revolution against globalization. Right wing governments are being elected in Hungary, Italy, Austria, partly in Germany, and elsewhere, reacting against the ravages of globalization – particularly, the claim that blue collar workers are being scalped by it – by migrants (free flow of labor) and by trade (free flow of goods).

America, which invented this amazing system that made many emerging economies wealthy (East Asia, primarily) now leads the charge against it.

And this whole counter-revolution is based on a falsehood. Don’t blame trade. Blue collar woes have another primary cause, according to Harvard University Professor Elhanan Helpman, in his new book Globalization and Inequality. It was not primarily free trade (globalization) that caused the large gap between blue collar and white collar wages.

Earlier, in 2016, Helpman published an NBER working paper * showing this (typically understated, as academic researchers are wont to do):

Trade played an appreciable role in increasing wage inequality, but its cumulative effect has

been modest, …globalization does not explain the preponderance of the rise in wage inequality

within countries.

What, then, does explain it? Technology and productivity.

Studies show that the premium for a college education (i.e. skilled workers) was 63%. The blue collar/white collar wage gap results from basic supply and demand factors, “…the dominant cause was an increase in the relative demand for skilled workers”.

OK – so who is to blame? American political leadership, for failing to find ways to upgrade the skills of blue-collar workers, especially in America’s failing and failed educational system. And, as New York Times op-ed columnist David Brooks has noted – the educated elite simply ignored the plight of the non-educated elite – and the price they pay is the election of Donald Trump.

* Elhanan Helpman. “Globalization and wage inequality”. NBER working paper 22944, Dec. 2016.

Did Open Borders Destroy U.S. Manufacturing?

By Shlomo Maital

In the recent US Presidential election, Donald Trump campaigned largely on how trade (i.e. imports, open borders) has destroyed blue-collar jobs. His voters agreed.

But is this true? Have globalization, open trade in goods and services, and cheap imports, destroyed good US jobs? Or were there other causes?

You won’t find a more authoritative answer than that from MIT, in Suzanne Berger’s 2013 book Making in America: From Innovation to Market (MIT Press), based on her work with the MIT Task Force on Production in the Innovtion Economy.

Here are some relevnt passages:

“Even taking into account job losses resulting from outsourcing as well as import competition, it was difficult as recently as a decade ago to find clear evidence of a heavy impact of open borders on manufacturing employment. …In 2003, [such job losses] involved less than one percent of layoffs; in 2004 they went up to 2 per cent. …job losses in manufacturing were mainly the result of productivity gains which might reduce the total numbers of those needed to produce a finite quantity of goods. …[Studies showed] the bottom line was that Chinese imports accounted for 33 per cent of manufacturing job decline between 1990 and 2000 and 55 per cent between 2000 and 2007. But [focusing mainly on rising Chinese productivity and falling China-facing trade barriers] 16 per cent of manufacturing job losses between 1990-2000, and 26 per cent between 2000 and 2007, were attributable to rising import competition from China.”

Bottom line: At most, a third to a half. And more likely: one-sixth to one quarter of job losses were due to Chinese imports.

So what does that mean? There were other causes, deeper ones. Labor-saving machinery and automation (robots). Low skills. And dumb policy. Berger notes: “Germany abandoned much of its low-end manufacturingwhile expanding employment in higher value-added segments.” And America??

Recently a former senior VP of Intel, Mooly Eden, spoke at Technion and noted that the moment manufacturing wages rose in China, Intel shifted to Vietnam and built 1 million square feet of manufacturing capacity there.

China lost jobs – why? Globalization? Or because their productivity failed to keep pace with wage increases?

It’s hard to predict the future. But here is one pretty safe guess. While Trump tackles America’s job problem and rebuilds manufacturing, based on a wrong assumption, he will fail. It won’t help to start a trade war with China. So in four years, his supporters will find that he failed to deliver.

What then? Will they vote Democrat? Or will we get an even farther-right crackpot candidate, as has happened in Europe?