You are currently browsing the tag archive for the ‘Wall Street’ tag.

How Legal “Front Running” Rips YOU Off –

Wall Street Strikes Again

By Shlomo Maital

Remember Michael Lewis’ book Liars’ Poker? The book that exposed Wall St. manipulations that eventually destroyed the world? The book that MBA’s bought, massively, so that – they could learn how to make $250k a year for doing nothing, as Lewis did briefly?

Lewis is back with Flash Boys, about another Wall St. ripoff. OK, the book has been out for a whole year, I’m a bit late.

Here is how it works:

“Front-running” is an illegal financial practice. Suppose you order 100,000 shares of IBM. (Some pension funds do). Before the broker executes the ‘buy’ order, he buys 50,000 IBM shares for his own account. Then, buys 100,000 shares for his client. AT A HIGHER PRICE! Because his purchase has raised the demand and the price. The pension fund loses money. Not a lot, but – it adds up. Then – after executing the pension fund order, which raises the price of IBM shares, the broker SELLS the shares HE bought, at a profit. This profit has come directly at the expense of the pension fund. And – THIS PRACTICE IS ILLEGAL. But, very hard to prove, hard to identify, and it’s done all the time.

Now, Michael Lewis has shown us how to do it legally. Buy orders for securities go to stock exchanges via fiber optic cables. These orders travel at the speed of light. But, still, if the cables are long, it takes a few milliseconds. Suppose, you learned about the order to buy a security, ALL securities, and through a computer algorithm, and a SHORT fiberoptic cable, could BUY the security BEFORE the order is executed, 2 milliseconds before. The order to buy would then be executed at a higher price, because…the price has gone up. After the order to buy is executed, you sell the security, and pocket a few cents’ profit. This is called High Frequency Trading, all done with super computers and algorithms, without human intervention. This is front running. AND IT IS LEGAL. It costs pension funds and other funds (OUR money) billions, maybe $10 billion or more. Who pockets the profit? Wall St. high frequency traders.

Who exposed this? A single person, the chief trader for the Royal Bank of Canada, in Toronto, a young man named Brad Katsuyama. Here’s how Wikipedia describes what he did (recounted in Flash Boys):

While at RBC, he noticed that placing a single large order that can be fulfilled only through many different stock exchanges was being taken advantage of by predatory stock scalpers. Scalpers, noticing the order would not be able to be fulfilled by one single exchange, would instead buy the securities on the other exchanges, so that by the time the rest of the large order arrived to those exchanges the scalpers could sell the securities at a higher price. All these events would happen in milliseconds not perceivable to humans but perceivable to computers. He instead led a team that implemented THOR, a securities’ order-management system where large orders are split into many different sub-orders with each sub-order arriving at the same time to all the exchanges through the use of intentional delays.

Katsuyama quit his job at RBC, and launched IEX, a new stock exchange that prevents all such high-frequency scalping. IEX is still very small, but growing. Katsuyama took a huge risk. As chief trader, he made a very high salary. He had a hard time persuading his wife that he had to do this, to start IEX, at huge risk. He has powerful wealthy enemies who are doing everything to scuttle IEX. And the regulators? Basically, they are asleep, or out to lunch.

Wall St. and the banks lost our trust totally in 2008. In theory, they should be working to regain it. Instead, extreme greed has again destroyed whatever molecules of trust was left. Lewis’ new book proves to me that in the battle between regulators and greedy speculators, regulators can never win. Only courageous individuals like Brad Katsuyama, and authors like Michael Lewis, can fight back.

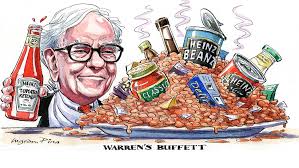

The Truth About Wall Street from Warren Buffett

By Shlomo Maital

Each year, legendary investor Warren Buffett, CEO of Berkshire Hathaway, writes a letter to shareholders, the mostly widely read document of its kind, as it has many pearls of wisdom – and of course, Buffett’s incredible track record gives him credibility. You can easily download and read the whole thing. I recommend it. Here are some snippets, drawn from Andrew Ross Sirkin’s New York Times column on March 4:

On Investment Bankers: “…constantly urge acquirers (of companies) to pay 20 to 50 per cent premiums over market price….they tell the buyers the premium is justified for ‘control value’ …a few years later bankers – bearing straight faces – again appear and just as earnestly urge spinning off the earlier acquisition in order to ‘unlock shareholder value’.” Sorkin comments “there are countless example of the build-it-up-and-tear-it-down phenomenon, like Hewlett Packard.” Of course, investment bankers charge huge fees for this brilliant manipulation.

Any true redeeming social value in all this? Buffett sees none and neither do I.

On Wall St. in general: “Money-shufflers don’t come cheap”. Money shuffling. Any true redeeming social value in this? You won’t find it with an electron microscope.

On private equity: “Equity is a dirty word for many private equity buyers; what they love is debt. And because debt is currently so inexpensive these buyers can frequently pay top dollar. Later the business will be resold, often to another leveraged buyer. In effect, the business becomes a piece of merchandise.”

Sorkin quotes Buffett’s comparison of Berkshire Hathaway (which buys share and companies, and holds them, often forever) and other investment funds: “You can sell it to Berkshire and we’ll put it in the Metropolitan Museum…by itself, it’ll be there forever. Or you can sell it to some porn shop operator, he’ll stick it up in the window and some other guy will come along in a raincoat and he’ll buy it.”

And yes, Buffett believes in real companies that make real stuff, like Heinz ketchup.

An enormous industry is thriving on the cheap money that American and European central banks are printing. That money was supposed to finance real capital formation. Instead it is financing speculative money-shuffling, making big profits for the very people who crashed the world’s economy in 2008.

If you don’t believe me, ask Warren Buffett. Or read his letter.