Global Crisis/Innovation Blog

Kyle Bass Sees What is Plainly Visible But Unseen

By Shlomo Maital

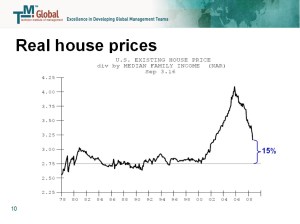

US house prices/median family income, 1978-2008

In a previous blog, I quoted Peter Drucker, who “saw what is visible but unseen”, just by looking out the window. Kyle Bass did the same. He worked at Bear, Stearns, becoming at age 28 the youngest senior managing director in the firm’s history. He is now the managing partner of Hayman Advisors LP, an investment firm which he founded in 2005-6. Bass is famous (notorious?) for foreseeing the subprime mortgage crisis and profiting from it immensely, when most of us just didn’t see it. He realized before anyone that private bank debt would become sovereign debt, and that Greece’s debt was too big for Greece to be able to pay back. He bet on that — when Greece’s interest rates were nearly equal to Germany’s. He won big time. He was recently interviewed on the BBC program “Hardtalk”. Here is what he said:

“ in 2001 [Fed Chair Alan] Greenspan traded the dot com bust for the housing boom, lowered interest rates to 1%, because he thought that was how to come out of the dot.com bust aggressively. Then he quit…handed the reins to Bernanke. We [at Hayman] looked at: median home prices, median income that had moved in parallel for 50 years…and at affordability. When Greenspan created the housing boom, there was massive divergence between median income and median home price [see figure above]…home prices took off, median incomes stayed stable… How did we profit? When you are a fiduciary, like Hayman, people invest their capital with us, in order to not lose and to make good risk adjusted returns… in 2006 we had a portfolio of investments all over the world… the hedge we did, we bet against the bottom 3% of subprime securitization, it cost me 1% a year.. it was the best asymmetric hedge I’d ever seen in my life… we were long in the fund, so this was our hedge, just in case something went wrong. We knew something would go wrong. We had a good hedge against it. We lost on other investments, profited on the subprime hedge, and made profit overall.

“We have a large portfolio of global investments. And enormous hedges in Europe and in Japan. We realized the crisis would move from housing, to banks, to govt. We did math which other people did not do. As the housing problem metastasized, it started to move globally, what we saw was, beginning of 2008 to Q2 2009, every time a highly levered institution got into trouble, in US and EU, the Central Banks took those bad private risks/assets and moved it onto the public balance sheet. [It was called a ‘bailout’, ‘too big to fail’.] We decided in mid-2008, there would be either massive delevering (deleveraging, write-off of bank debt, including bankruptcy), or would the move onto the govt. balance sheet. The latter happened – in the US and partly in the EU they moved bad private assets onto the govt. balance sheet. No one did this calculation…looked at how big debts were, how big revenues were, for govts. What solidified our search was: for Iceland, 300,000 people, $20 b. GDP, 3 Iceland banks had over $200 b. worth of assets!. When the Icelandic banks went bad, it sank the country. No regulator existed, deciding to put limits on the size of banking system relative to GDP…because it generated revenues, jobs.

“The global debt scenario? Yes, we took bets against Greece… for a $1,000 bet, you could make $700,000 profit, in the initial stages, 2008. Greece’s sovereign debt traded as if it were German sovereign debt… it was within 11-17 basis points of German debt. That’s 11/100 of one per cent. There were great asymmetric hedges then. Today, all the asymmetry hedges in the world lie in Japan.

“The only way to resolve EU problems is to have massive debt restructuring, write-downs. You know Europe is in trouble when it has a German Pope, and an Italian Central Banker. World sovereign debt has grown in the last 9 years from $80 trillion to $210 trillion. That’s 12% / yr., while GDP grew at 4%. It is not sustainable. The “PIIGS” (Portugal, Iceland, Ireland, Greece, Spain) are heading into insolvency. There is noo solution but – either pay the bills, or debts have to be written down. Germany itself has defaulted twice in the last 100 years. Germany hasn’t recapitalized its banks.. UK, US HAS! EU banks have three times the leverage of US banks. EU hasn’t recapitalized its banks. Issue Eurobonds (with no country on the face)? So profligate Southern European countries continue to spend wildly and Germany foots the bill. Profligate countries blackmail Germany every time. It’s not to Germany’s benefit. How many of your relatives would you go joint and severally liable with? EU won’t work unless it has centralized taxing authority, until every one of the 17 Euro nations cedes sovereignty. This is a tall order. The [bond] market is telling us, it won’t work. Japan? It will fall big time. Japan has the single worst balance sheet problem with sovereign debt in the world… in Japan: a xenophobic society, population decline, they will lose 27 m. people in next 40 years to demography…private assets of the public in Japan are close to $13.2 trillion…but govt. debt is $15 trillion – the first time in history a country’s sovereign debt exceeds private assets…. In Italy, the 10 yr rate went from 5% to 6%: and Italy went to full crisis, in one percent! Japan spends 50% of central govt. tax revenue on debt service, and half is interest… if Japanese interest rates rises 2%, debt service will alone exceed govt. revenue!”

Kyle Bass went to college (Texas Christian University) on a combined academic/sport scholarship (he was a champion diver). As a talented high diver, he knew how to take leaps others did not. His leap into betting against subprime mortgages was a huge success. Perhaps then, we should listen to what he says about the euro and Japan.

6 comments

Comments feed for this article

November 20, 2011 at 2:18 am

mbaDad

I knew that house prices on a large scale average tend to track with inflation. When many ask when house prices are going to recover, I always ask “from what”? It is not how far off peak housing is now, but how close to where it “should be” that I had yet to see until the excellent chart on this page. We have certainly over built, and the only real solution is to wait for demand to catch up to supply. At that point our highly deflated prices actually be back to normal.

November 20, 2011 at 6:36 am

timnovate

Good point. As the graph in my blog indicates, housing prices are still returning to their long-term average, relative to ‘affordability’ (median family income). The best we can hope for is for housing prices to stabilize, not rise.

November 20, 2011 at 10:03 pm

JH

So then for the small investor, what is the investment (ETF or otherwise) one can make assuming Bass is right about Japan? What are the vehicles to short Japan?

November 21, 2011 at 6:11 am

timnovate

No small investor should or could do what Bass’s investment fund did, and continues to do. Especially not ‘short’ Japan. Japan’s attitude to debt obligations is unique. Remember, after the Tokyo property bubble burst in 1990, many people were left with mortgage debts half or less of the value of their homes. Yet for two decades and more, they continue to pay them! (Because if they don’t, their co-signers, mainly family, will have to). So in Japan a debt is a sacred obligation. No way I would bet on the Japanese govt. defaulting….

November 22, 2011 at 2:47 am

I-Kuan Lin

I heard your talk on BBC World Service three days ago. I thought it was very disciplined. Can I find the transcript for it anywhere?

November 22, 2011 at 6:31 am

timnovate

http://www.bbc.co.uk/iplayer/episode/b01771pd/HARDtalk_Kyle_Bass_Founder_Hayman_Capital_Hedge_Fund/