You are currently browsing the tag archive for the ‘economy’ tag.

Why Economists are Baffled by the Data

By Shlomo Maital

What in the world is going on with the US economy? Economists are …well, out to lunch.

Why? Labor data is down. GDP growth is way up in the last quarter. Hmmm…

This is what Jason Furman, former head of the White House Council of Economic Advisors, writes in his New York Times Op-Ed piece?

“Economic data never tells a perfectly clear story, but lately the contradictions have been especially jarring. Just a week apart, the government delivered two sharply conflicting messages. One report showed job growth stalling and unemployment rising. Another showed the economy expanding at a blistering 4.3 percent annual rate — more than double the pace of the first half of the year.”

Unemployment is significantly higher than in previous periods. Job growth is small or maybe even negative. But GDP is growing at 4.3 per cent, double the rate earlier. Furman asks: Are we sliding toward recession or entering a new boom?

GDP growth without labor growth?

Could this be the result of AI replacing human labor? Probably not – Not enough companies are dumping people because their work is redundant and done by AI.

Wrong data? Job data is often wrong and updated – that brought a Trump tantrum the last time it was revised down. GDP data too is often updated.

It reminds me of the lovely sad Beatles song, with the repeated line “nothing’s going to change my world.” We economists analyze data with the insights and models and tools of the past. But…our world has changed. And so has the economy. And how people behave, spend, invest, save….

Disclosure: I have unofficially resigned from the army of professional economists. A profession that pitched unbridled capitalism, yet failed to anticipate why, say, a Board of Directors giving Elon Musk a trillion dollars in compensation might be obscene and needed fixing or forestalling – there is no hope.

I wonder what will be said to Economists when they reach the Gates of Heaven – and admit they are economists. I have a hunch.

Europe Is In (Big) Trouble

By Shlomo Maital

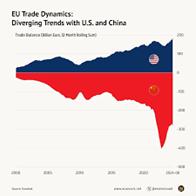

US trade deficit (top) EU trade deficit (bottom)

In her NYT Op-Ed today, March 10, Karen Karniol-Tambour clarifies President Trump’s murky tariff quirks.# I find the above diagrams helpful, along with her analysis and my own. The top diagram shows the US trade deficit (exports minus imports) since 1990, and the bottom one, the EU’s trade deficit, split between a large and growing surplus in its US trade, and a growing and very large deficit in its China trade. (Bottom diagram: Black is export surplus with the US; Red is import surplus with China). Source: Visual Capitalist.

Since 1990, and actually since 1970, the United States has consumed more than it produced. It does this by buying stuff abroad. To pay for it, it borrows and goes into debt. It can do this, because US money, the dollar, is the world currency and those who earn the dollars are willing to hold them or turn them into US bonds. (If you or tried this, it would not take long to go broke. When the US does it, it can print the money to enable it.) The infusion of US demand in the world economy has made Asia, specifically China, wealthy. There are 400 Chinese billionaires! In a Communist nation! But it also helped Europe. The EU sells more to the US than it buys.

Most of what the US consumes, above what it makes, is manufactured goods, mostly from China, but also, from Mexico, Vietnam, Japan and Germany.

The US gave away its manufacturing to China and the rest of the world, under Clinton, Bush, Obama…and Trump (2016-2020). Trump thinks it can return, by imposing high tariffs on imports. It will make us a fortune, he says. If it does, it means that imports remain very high. So – forget US manufacturing. If it doesn’t make a fortune, it means that imports become very expensive and import inflation, not just Chinese EV’s.

China has had 25 years to build its manufacturing supremacy. In a country that controls the economy directly. To get its manufacturing back, the US will need at least 25 years, probably more, in a free market economy, if, IF, all the right policies are put in place. But …of course, they are not. Tariffs are not the answer.

The EU is in huge trouble. For two reasons. Defense. And Economy.

Defense: The US is throwing Europe and Ukraine under the Russian bus. After years of sponging off the US $850 billion defense budget, Europe now has to defend itself. That will take large resources and a lot of time. And Russia is knocking on the door right now. The next few years will be very dangerous for Europe.

Economy: The US wants to shut down its big trade deficit with the EU. IF it does, through tariffs, it will hurt the EU economy, with Germany already in recession or nearly so. Meanwhile, the EU has a large and growing trade deficit in manufactures with China. Europe’s car industry is in desperate trouble. With technology shifting to electric vehicles, China is swamping the world with its EV’s, and Europe is way way behind. So Europe faces big challenges from BOTH the US and from China.

The economies of the US, EU, and China are roughly equal in size, and comprise 75% of world GDP. All three have big problems. China has a bloated construction, real estate and finance sector, deep in debt. US has an unpredictable president with wrong-headed ‘quick fixes’ that really are quick disasters. EU needs a rapid, smart, strategic U-turn, very unlikely in a group of 27 countries where you need unanimity to do anything – and outliers like Hungary are happy to put up roadblocks.

The US gave away its manufacturing to China, under four presidents, Democrats and Republicans. You cannot have a strong healthy growing economy without making stuff. The US stock markets are reflecting this.

Because the US consumed much more than it made, it has a heavy burden of debt, 110% of its GDP, and a trillion dollars in interest alone. And as Trump slashes taxes, the budget deficit grows and with it, US debt.

EU enjoyed trade surpluses with the US, offsetting in part its trade deficit with China. The US under Trump wants to end that.

In a EU economy already slowing, and with a Russian army on its flank, and with EU technology trailing that of the US and China, the EU is in deep hot water.

And, when 75% of the world economy is in some degree of trouble – we are all of us in hot water.

Friends: Set aside a bit more in saving. You may need it.

# “This Is Who Loses in a Trade War. Karen Karniol-Tambour, New York Times, March 10, 2025. The author is co-chief investment officer at Bridgewater, an investment management company.

Trudeau Socks It To Trump

By Shlomo Maital

I just watched Canadian Prime Minister Justin Trudeau sock it to Trump, a week before he leaves office. “Very smart”, Trudeau described Trump – but “ very dumb” to slap 25% tariffs on Canadian goods. Dumb, because the US and Canadian economies are highly integrated, through a trade agreement negotiated by Trump himself, in his first term. This is especially true of the automobile industry; a US car exec said this 25% US tariff on Canadian imports will “blow a big hole” in the US industry.

Trudeau is retaliating with 25% tariffs on a wide range of US imports.

Let’s face it. The US has a problem. It has imported about $50 b. more in goods per month than it exported, up to 2020. Since then, that monthly deficit has doubled, to about $100 b. a month. The US now has a $1.2 annual trillion trade deficit. Only the US can live so far beyond its means – because it pays in dollars, the international money, and it can create dollars (through credit) and borrow dollars by selling bonds to foreigners, who accumulate dollars through trade surpluses (e.g. China).

The US exports $349 b. yearly to the US, and iimports $412.7 b. That is a deficit of about $63 b., or just over 5% of America’s overall deficit. Mexico exports $505.3 b. to the US, and imports $334 b. That is a US trade deficit of $171 b., or just under 15% of America’s overall trade deficit.

China and the European Union are the big ones. China’s trade surplus with the US is $295.4 b., or 25% of the total US deficit, and the EU has a $235 b. trade surplus with the US, or roughly 20%.

What do these numbers mean? The US has leveraged the fact that the dollar is the world’s currency, to live beyond its means, buy much more than it sells abroad, and borrows to pay for it. America spends more in interest on its national debt than it spends on defense — $1 trillion!

Trump has a quick fix. Tariffs. Why won’t this work? Why is it dumb? He tariffs Canada at 25%. Canada responds in the same way. So nothing changes – US exports and Canadian exports each get 25% more costly, meaning their relative prices remain the same. So all that happens, is that US exports to Canada and Canadian exports to the US both decline, because they are more expensive – but no advantage accrues to either country. Trade declines. Both countries lose. Prices go up in each country.

There is a way to deal with the fact that the US has lived far beyond its means for years. Invest in education. In infrastructure. In productivity. In modernizing factories. In becoming more efficient and competitive. That takes government investment and smart policies, and a long run policy. Biden began, with an infrastructure bill that brought semiconductor factories to the US (Trump took credit on TV for bringing Taiwan’s powerhouse TSMC to the US, but that was done under Biden).

Tonight, in his speech to Congress, Trump will blame everybody else but the US for its trade deficit. But it is the US itself that is responsible. It has fallen far behind, by building a consumption society (70% of GDP), while China built an investment economy (nearly a third of GDP).

China is an ant. America is the grasshopper. It’s pretty simple. And pretty obvious. But – expect half of Americans to buy Trump’s snake oil pitch tonight and applaud him.

It’s a shame.

Trumponomics

By Shlomo Maital

(from The Economist)

“Trumponomics” is the economic theory that drives President Donald Trump’s planned economic policies. It includes low interest rates; tariffs on China, Mexico and Canada, and anyone else that sells more to the US than it buys; expelling immigrant workers; slashing taxes; removing renewable energy subsidies.

What can we expect? Here is Olivier Blanchard’s ‘take’. He is an MIT economics professor, former chief economist of the IMF.

“….perhaps the most crucial issue is what the Fed will do. If it sticks to its mandate, it will stand in the way of some of Trump’s hopes from the use of tariffs, deportation, and tax cuts. It will have to limit economic overheating, increase rates, and cause the dollar to appreciate. The big question is thus whether Trump can force the Fed to abandon its mandate and maintain low rates in the face of higher inflation.”

To explain: The US already has a huge federal budget deficit, some 7% of GDP. US public debt exceeds its annual GDP. Trumponomics tax cuts and gifts to the wealthy will further hamper revenues and increase the deficit. Tariffs will make goods and services more expensive for consumers (no, people, it is not the Chinese or Canadians who will pay the tariffs, it is us). The result will be more inflation, rather than, as promised, less.

Enter the Fed: Higher inflation brings tighter interest rates. Trumponomics is in love with low interest rates. Result: A cataclysmic conflict with Fed Chair Jerome Powell, who remains in his post until 2026. At that time, Trump may try to appoint a non-mainstream new Fed Chair, who will maintain low rates in the face of inflation – leading to more inflation.

The US has been successful since 1776, mostly, because its Judiciary (Supreme Court) and its money people (Federal Reserve) have been constitutionally isolated from political influence, in general. The judiciary now has a Trump majority. When the Fed too falls into Trumponomics – yikes. Risk premiums on US bonds rise, as capital markets start to wonder whether the US may, like Nicaragua or South Africa, fall into fiscal decay.

Here is Blanchard’s conclusion: “Fed Chair Jay Powell has made clear he remains committed to the mandate and to staying at the Fed as chair until his term as chair expires in May 2026 (his term as board member ends in 2028). Current Fed board members are unlikely to follow a different line. But one board position opens in January 2026, and Trump could seek to name a more docile board member to the seat. If this is the case, and the board goes along (which is unlikely), the result will be low rates, overheating, and higher inflation. Given the unpopularity of high inflation, not to mention the reaction of financial markets to the loss of Fed independence, this prospect may be enough to make Trump hesitate to pursue this option.”

Stay tuned! We are headed for interesting times.

G7 vs BRICS: Lose Lose.

By Shlomo Maital

As Donald Trump prepares to be inaugurated as US President on January 20, a rather bleak picture emerges of a wrestling contest between two teams: BRICS and G7. And it will not end well, at least not initially.

BRICS is the group of anti-US anti-West countries: Brazil, Russia, India, China, South Africa. According to recent figures, their total Gross Domestic Product, measured by the true dollar value of their currency rather than the distorted market value, is $62 trillion.

Facing off against them is the G7: the group of pro-West economies led by the US. Their GDP comes in total to $53 trillion. (Note: China’s GDP, in $, is $33 trillion, more than $4 trillion above that of the US, at $29 trillion).

Together, these two groups command $120 trillion of the world’s $138 trillion GDP.

Trump plans to impose tariffs, including on key trading partners such as Canada and Mexico. They and others will doubtless retaliate. This will reduce the volume of world trade, which since the 1944 Bretton Woods agreement has made many poor countries much wealthier.

We have seen this movie before. In the 1930’s Depression, the US imposed a heavy tariff on imports, the Smoot-Hawley tariff, and its trading partners retaliated. In just a few years, world trade all but disappeared, making the Depression worse for all.

Somehow, humanity seems to have to relive its mistakes again and again, and relearn their consequences. “I can make you poorer, at my expense,” says country A, and country B says, “so can I”.

And they’re both right.

If the US Economy is So Good – Why Is It Perceived as Bad?

By Shlomo Maital

Many experts – and Democrat strategists – fretted, worried, puzzled, pontificated and blustered over why the US economy did so well, by the numbers, and was perceived as so bad by working people.

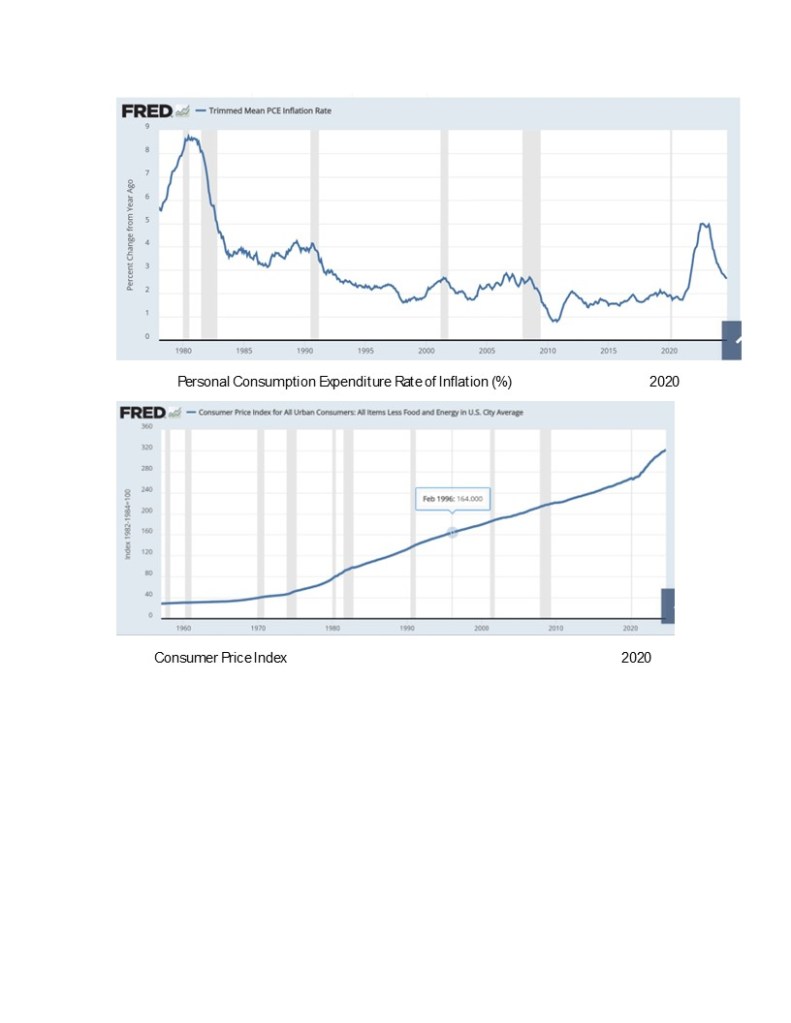

The above two graphs, thanks to the St. Louis Fed’s superb software “FRED”, provides an explanation.

In 2020 inflation (measured by the year to year percentage change in the personal consumption expenditure price index, which measures the price of what people buy) peaked at over 4% — and then fell sharply to around 2 per cent, leading the Fed to slash interest rates. See the top graph.

Good news, right?

In October 2024, just before the US Presidential election, the consumer price index was 321.7, up from April 2020’s level of 265.7. That is an increase of 21.7%. That means – what people bought just before the election was 21.7% more expensive than in April 2020, just before Biden won the election. During that time, the wages of low-income working people did not come close to rising by 21.7%. That means, a lot of people were struggling in 2024 to buy what they bought relatively easily in 2020. See the bottom graph.

The difference is simply this: Some measure inflation by the rate of change But ordinary people measure it by what they can buy at the supermarket. Good work for bringing down the rate of inflation! But – did you fix the damage the inflation did before you got it under control? Raised the national minimum wage to $15? No? Then – you will lose the election.

China – Newest Global Growth Engine?

By Shlomo Maital

source: Bloomberg

Once, when the world economy was in trouble, there was a locomotive to pull it out of stagnation – the US economy. After World War II, when the rest of the world was destroyed, the US supplied purchasing power through its imports. With frequent global recessions, again the US appetite for consumer goods supplied badly-needed demand for the world.

Today? With an incompetent xenophobic addled President (at least for the next 13 days, or 92 days until the Inauguration), and the pandemic worsening in the US in up to two-thirds of all states — the United States is not the locomotive but in fact the quicksand.

Enter China, vilified by Trump, but arguably emerging fastest and strongest from the pandemic. China’s quarterly GDP growth rate annualized, is nearly 5%…. and that means demand for imports, especially from the Asian ecosystem at which China is at the center. China can be at least a regional locomotive, and the effects will spread more widely.

Why has China’s economy done a “V-shaped” recovery, when the US recovery, and that of the EU, are far more likely to be flat-bottomed U-shaped?

China’s local authorities have poured easy credit and infrastructure projects into the economy; lockdown has virtually ended, and when the virus rears its head, China rapidly tests millions of people, to gain control.

It is possible to admire China’s economic resilience, while fiercely criticizing its flawed civil rights. Why cannot every nation learn from other nations, embracing the good, rejecting the bad?

Bloomberg News shows regularly how the US economy is lagging – and the conclusion is, you cannot jumpstart an economy without gaining nearly-full control of the virus. The failed US administration – not just the President, but the incompetent Cabinet and advisors he has appointed, including Dr. Atlas, who espouses ‘herd immunity’ and denigrates masks — will go down in history as one that outdid Calvin Coolidge (1928-32) in failing to see what was clearly written on the wall.

It’s NOT the Economy, Stupid!

Trump’s Former Chief of Staff Speaks Out

By Shlomo Maital

Mick Mulvaney, former Trump Chief of Staff

“It’s the economy, stupid” is a phrase coined by James Carville in 1992. Carville was a strategist in Bill Clinton’s 1992 presidential campaign against George H. W. Bush. His phrase was aimed at campaign workers. Carville wanted it to be one of three messages for them to focus on. The other two were boring and not worth mentioning.

Clinton used the 1991/2 recession in the United States to successfully defeat George H. W. Bush.

Fast forward. President Trump pushes prematurely to open schools and get the economy restarted. A massive second wave of coronavirus occurs. And his former Chief of Staff, Mick Mulvaney, speaks out against him, in a CNBC Op-Ed. Here is what Mulvaney, until very recently privy to the innermost circles of the Trump administration, said today:

“….lawmakers still see the need to run the [money] presses, they need to realize that the current economic crisis is public-health driven. As such, using ordinary fiscal tools might not be particularly efficacious. Put another way, the fact that people aren’t going on vacation probably has more to do with fear of getting sick than it does with their economic condition. Giving people a check, or some financial incentive to travel, won’t solve their problem. Make people feel safe to go back on an airplane or cruise ship, and they will of their own accord. Any stimulus should be directed at the root cause of our recession: dealing with Covid. I know it isn’t popular to talk about in some Republican circles, but we still have a testing problem in this country.”

Yes, you got it. It is NOT the economy, Stupid. (Mulvaney did not say ‘stupid’). If you don’t gain control of the pandemic, you will not be able to restart the economy, schools or no schools. It’s that simple. It is the VIRUS, Stupid! People won’t spend until you get control of it. And personal consumption is 70% of GDP, or $13 trillion, in 2019 (pre-pandemic).

Government programs can spill massive amounts of money into the economy, including IRS checks sent to dead people. But they can’t come close to what people spend, when and if they are comfortable, confident and reassured. So, it is NOT the economy, it is the public health crisis. Tackle that first!

It’s that simple. Trump’s inability to understand that will cost him a heavy defeat on Nov. 3 – but it will cost the American people far more, until Biden is inaugurated on Wednesday, January 20, 2021. That’s 190 days away! More than half a year. A lot of people are going to get sick, and some will die, during those six months.

Very very sad. Very very troubling. Very very angering.

,

It’s So Darn Simple! Wear the Damn Mask!

By Shlomo Maital

Listen carefully. Wear the damn mask! In Asia, countries where people are used to wearing masks, and do so, have fewer cases. Wear the damn mask! Make it a federal requirement. Personal freedom? First amendment rights? Come on, blockheads – you do not have the right to infect others and endanger their lives.

But hey – don’t believe me. Would you believe Goldman Sachs? They are very careful about what they say – the service investment banks offer is mainly trust and credibility. And Goldman Sachs says, 60% (you got it – 60%) of current cases could be prevented if everybody, everywhere, would wear masks in public. If everybody agreed to wear the damn mask, it would not be so necessary to keep shutting and opening restaurants, bars, beaches, small businesses, etc. The benefits would be huge.

So why don’t people wear them in the US? Why are cases spiking, in 30 or more states?

Ask your President.

Unless mask attitudes and behavior change fast, the picture for the US economy is bleak. Here is Goldman Sachs’ take on it:

“The sharp increase in confirmed coronavirus infections in the US has raised fears that the recovery might soon stall,” Jan Hatzius, Goldman’s chief economist, said in a note. “Although a significant part of the increase reflects higher testing volumes … a broader look at the CDC criteria for reopening shows that not only new cases but also positive test rates, the share of doctor visits for covid-like symptoms, and hospital capacity utilization have deteriorated meaningfully in the last few weeks.” GDP fell 5% in the first quarter, part of a mostly self-induced recession aimed at stopping the coronavirus spread. It was the biggest one-quarter drop since the fourth quarter of 2008, during the Great Recession. As cases decreased, states slowly began reopening amid hopes that the sharp drawdown would be short-lived. Indeed, even if Goldman’s reduced call is correct, that would mark, by a wide margin, the biggest quarterly rebound since at least 1947. The U.S. has seen 340,000 new virus cases over the past week, a rise of 13.4%. That has come with 3,447 deaths, a 2.9% increase.”

Keep it simple, Stupxxx. Wear the damn mask!

America’s 3 % Economy: Why It Is In Deep Trouble

By Shlomo Maital

Writing in the latest TIME magazine issue (Oct. 6), Rana Foroohar explains why the U.S. economy is in deep trouble – and why many are distressed that nobody seems to be tackling the core issues.

Foroohar says it has taken 41 months to replace the jobs lost in the “Great Recession” (2008-11). This is more than three years, far longer than in previous recessions.

But, which jobs?? Mostly, burger flippers, at $8/hr. “That’s a problem in an economy that’s made up chiefly of consumer spending. When the majority of people don’t have more money, they can’t spend more, and companies can’t create more jobs higher up the food chain. So, poor job creation and flat wages are holding back a stronger recovery in consumer spending.

Foroohar concludes: “If this trend is left unchecked, we are looking at a generation that will be permanently less well off than their parents.” This is disastrous, because there is an intergenerational contract, in which older generations offer younger generations the hope of better lives, jobs and strong futures. This is the first time the opposite is the case. We are giving our children a far worse economy and society than the ones we received.

This is by far the core issue today facing America –not ISIL. Let’s focus on the real issues. America’s real enemy is at home, not abroad – its own failing economy. A general estimates the war on ISIL could cost as much as $10 b. This is money needed for schools, colleges, research, innovation and technology. ISIL, the Islamic State, is hurting America deeply simply by diverting resources into jet fuel, smart bombs and cruise missiles. Boots on the ground? America needs special forces to ‘light up’ with lasers the true problem – education, poverty, and above all, low-wage jobs.