You are currently browsing the tag archive for the ‘Bloomberg’ tag.

Economic Recovery: We All Should Prepare for a Long Convalescence

By Shlomo Maital

How quickly will economies in the US, Canada, Japan and Europe bounce back? Will it be fast, like China, or very slow, like the US?

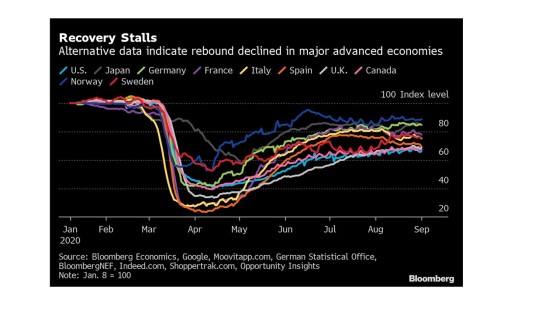

Bloomberg has been tracking this key issue, using a wide variety of indicators; the visual track for 10 countries is shown in the diagram.

It has been 5 months since these economies bottomed out, with 60% – 80% decline in the economy, owing to lockdown, in a very short period of a month or six weeks.

So far, no matter what the national strategy (or lack of one, as in the US) — herd immunity (Sweden), local lockdown (Italy), school-opening and back-to-normal prematurely (US) — economies are plateau-ing, at 60% to 80% of their previous pre-pandemic level. And in most of the 10, COVID-19 is making a comeback, in a second or third wave — with the age of those infected declining sharply, as young people emerge, head to bars, and parties, and colleges – and become ill.

And, if that isn’t bad enough, a new forecast from the leading pandemic prediction institution, at Univ. of Washington, reports this: A new long-term forecast predicts a significant acceleration in Covid-19 deaths in the U.S. as colder weather takes hold. Under the latest projections from the Institute for Health Metrics and Evaluation at the University of Washington’s School of Medicine, deaths could rise to 410,000 by the end of 2020. In a worst-case scenario, there could be 620,000 fatalities, more than three times the number of Americans who have died over the past eight months. The difference between the projected and worst-case scenarios comes down to how diligent authorities are in mandating masks and social distancing, according to the report.

Readers, fasten your seat belts. Many of us yearn for the good old days, like, those we have 6 months ago. It does not seem likely any time soon. Prepare yourself and your family for a rocky road to recovery. It will be a marathon, not a sprint. Even optimistists believe an effective vaccine won’t be available for many months – and then, how many vaccine-deniers will turn it down, lacking trust in leaders who follow politics rather than science?

No, Larry Kudlow, The Recovery Is NOT V-Shaped

By Shlomo Maital

Economic Activity in the World’s Major Economies

ImPOTUS (Trump) has surrounded himself with a battery of sycophants, including his chief economic advisor Larry Kudlow, who continues to insist the economic recovery will be V-shaped – sharp drop, and sharp recovery. The reason this is so destructive, is that much more stimulus is needed for the US economy – but the wrong-headed view that full recovery is imminent will prevent it. It is so painful to see crackpot economists running economic policy, when the US has stadiums full of truly brilliant economists, many of them Nobel Prize winners. The price for this folly will be heavy.

According to Bloomberg, the economic recovery – after a disastrous 40-80% decline in economic activity — has stalled, and is plateau-ing at around 80% of pre-pandemic levels.

“The recovery has stalled in major advanced economies, with some countries hitting a ceiling on activity that is below their pre-crisis levels, according to Bloomberg Economics gauges that integrate high-frequency data such as credit-card use, travel and location information. Euro-area economies such as Germany, France and Italy, along with Norway and Japan, are closest to their pre-pandemic readings, with Spain falling behind slightly. The U.K., U.S. and Canada are still far below their levels of activity at the start of the year”.

That is actually terrible — because it means we are in a deep recession and are remaining there. Historically, when the world economy fell into recession, the US economy was the locomotive that pulled it out of the mud, with large demand on the part of American consumers. Today, the US is run by those who reject any idea that the US has a responsibility for other nations’ wellbeing – and even if they believed they did, they are impotent.

What is the reason? There are two. First, governments, especially in the US, do not understand that in the absence of consumer demand, only government can fill the gap, and massive amounts of spending are required to rescue the economy. Debt-phobia (fear of public debt) is still alive and well — but if we remain stuck at 80%, even the existing debt will be tough to service, and if we can get back to 100%, the higher debt will be repaid from new revenues generated. Second, people are scared, uncertain (justifiably so), and are not spending.

People are not stupid. They see the weak government policies, and the US political deadlock – and hang on to their money. Even when restaurants do open, people are simply not going to eat in them. They understand that 80% far better than many economists and leaders. They fell it on their flesh.

The message here is – if you are fortunate enough to have current income, and not everyone does, set aside a portion of it, because you will need it in future. I have been telling people this for years, in good times, and now, in bad times, it is still valid, because the bad times can persist or get even worse.

The Pandemic is NOT Over

By Shlomo Maital

The Pandemic is NOT over. We are getting farther away from conquering it, not closer. Here are two disturbing reports from Bloomberg News, a credible source:

First the United States:

“By most accounts, the U.S. has failed spectacularly at managing the coronavirus pandemic. American-made tests were first defective, then largely unavailable; misinformation about the virus was broadcast in politicized White House briefings; and lockdowns weren’t enforced quickly enough, all of which likely worsened the spread of a disease that’s already killed 120,000 Americans. Now, with restrictions lifted earlier than advised and infection rates predictably spiking, calamities suffered in the northeast and northwest are re-emerging inland. And come fall, it may get even worse. Federal officials led by Dr. Anthony Fauci warn that this year’s flu season could overburden the health care system. —David E. Rovella”

And the rest of the world:

“The number of new Covid-19 cases around the globe is accelerating, fueled by a surge in Latin America. Germany’s infection rate rose for a third day, lifted by local outbreaks, including one in a slaughterhouse. However, Beijing reported only nine new infections, a sign that a recent outbreak may be under control. Infections and deaths reported by Russian officials also flattened. The overall global surge, though, is putting a world economic recovery in greater jeopardy. “

And to make things worse: There is some evidence the novel coronavirus has mutated, and in some mutations has become more virulent and harder for the body to step.

I often hear the claim that the new cases are largely among the young, which are populating bars and restaurants and beaches, and that even though the number of infections rises, the number of deaths remains steady or declines. The danger is, as the coronavirus spreads among the young, it will mutate and become more dangerous. And we will not be prepared. Moreover, these mutations make it much harder to successfully develop a working vaccine.

Will the Dollar Be the Next COVID-19 Victim?

By Shlomo Maital

Will the dollar be the next victim of COVID-19? Bloomberg’s Stephen Roach, former Morgan Stanley chair and now a Yale U Professor, thinks it might. Here is why.

Here in short is his argument: “Already stressed by the impact of the Covid-19 pandemic, U.S. living standards are about to be squeezed as never before. At the same time, the world is having serious doubts about the once widely accepted presumption of American exceptionalism. Currencies set the equilibrium between these two forces — domestic economic fundamentals and foreign perceptions of a nation’s strength or weakness. The balance is shifting, and a crash in the dollar could well be in the offing.”

The dollar for 75 years, since 1945, has been a safe haven for investors – a port in a storm, for their money. This may no longer be true. As US deficits mount – so far this fiscal year alone, the federal deficit totals $738 billion, and will likely double, out of a $20 trillion GDP, or a 7% deficit.

Since Americans save very little, US deficits have been funded by, among others, China, which has bought massive amounts of US Treasury bonds in the past. This is highly unlikely to continue, given the toxic atmosphere between Trump and Xi Jinping. So the only way the US will be able to finance its massive deficit spending, will be for the Federal Reserve to buy Treasury bonds, implying an enormous tsunami of cash flowing into the economy. Short-term, this may be OK; but long term, it could well undermine the value of the dollar, as the world becomes awash in them.

The dollar problem predates the pandemic. Roach observes: “The seeds of this problem were sown by a profound shortfall in domestic U.S. savings that was glaringly apparent before the pandemic. In the first quarter of 2020, net national saving, which includes depreciation-adjusted saving of households, businesses and the government sector, fell to 1.4% of national income. This was the lowest reading since late 2011 and one-fifth the average of 7% from 1960 to 2005.”

So – to simplify: If Americans do not save, and if the US government is dissaving, and borrowing like mad – who will lend it the money? Americans? No. Foreigners? Probably not. So if nobody is willing to lend to the US, except the Federal Reserve, the only alternative is to flood the world with cheap dollars. And that may spell doom for the global value of the dollar.

This may be wrong. But it is worth thinking about – one more thing to worry about, because the global economy depends on the dollar as a main key currency.

Trump is a Fraud – His Business Failures

By Shlomo Maital

Look… the American people have the right to choose whichever Republican candidate they wish for President. They have every right to shout their disaffection with the incompetent, squabbling politicians in Washington who have led American astray, on both sides of the aisle. They have every right to choose Trump.

But what truly disturbs and angers me, is Trump’s lie.

He says that as a successful billionaire businessman, he can run America better than someone who worked as a community organizer in Chicago.

Wait. Successful businessman? Here is the lie. According to TIME magazine, Trump has a very very very VERY long string of business failures to his ‘credit’, after inheriting millions from his dad. Here is the list:

- Trump Airlines

- Trump Vodka

- The Bankruptcies

- The Hair

- The Marriages

- Trump Mortgage

- Trump: The Game

- The China Connection

- Trump Casinos

In his recent victory speech he displayed Trump Steaks…which went out of business in 2007. And his casinos??? The Trump Taj Mahal in Atlantic City went broke. Here is the story: (from TIME):

Donald Trump’s gambles don’t always go as planned. Especially when that gamble is gambling itself. In February 2009, Trump Entertainment Resorts Inc. filed for Chapter 11 bankruptcy protection for the third time in a row — an extremely rare feat in American business. The casino company, founded in the 1980s, runs the Taj Mahal, the Trump Plaza and the Trump Marina. All three casinos are located in Atlantic City, N.J., where the gambling industry has faced a decline in tourists who prefer gambling in Pennsylvania and Connecticut instead. Trump defended himself by distancing himself from the company, though he owned 28% of its stock. “Other than the fact that it has my name on it — which I’m not thrilled about — I have nothing to do with the company,” he said. He resigned from Trump Entertainment soon after that third filing, and in August of that year he, along with an affiliate of Beal Bank Nevada, agreed to buy the company for $100 million. The company reported it emerged from bankruptcy in July 2010.

I think what Trump is doing is running for President, to enhance the brand value of his name, which he sells at exorbitant prices to legitimate businesses.

So, if you want to help Donald Trump pay for his private jet by ‘branding’ himself, vote for him.

If you want someone who really understands business – well, Bloomberg does, parlaying his $10 m. in severance pay into a multi-billion dollar business he created, but he withdrew, precisely because he did not want to pave the way for a Trump presidency.

How ironic.

A failed businessman defeats a highly successful one, because people just don’t seem to get it and are happy and willing to be duped.

Make America Great again? Dump Trump.